Understanding how financial aid works—including eligibility requirements, academic progress standards, cost of attendance, and available funding options—is key to making the most of your college experience and avoiding unexpected surprises.

Accept/Decline or Revise Your Financial Aid Offer

Using your UserID and password, log on to the CampusConnection Portal.

If your UserID or password is unknown, click here for CampusConnection help.

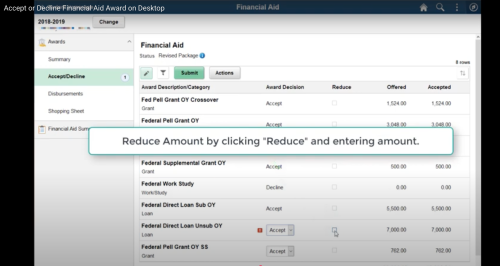

How to Accept/Decline Financial Aid Offer on Desktop

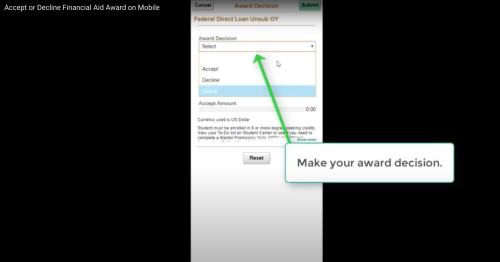

How to Accept/Decline Financial Aid Offer on Mobile

First Time Borrowers

Federal Direct Loan(s) - Subsidized/Unsubsidized

If you are accepting a Federal Direct Loan (and you are enrolled in at least six credits), you must complete a Master Promissory Note (MPN) and Entrance Loan Counseling at StudentAid.gov.

To Complete the online sessions:

- Go to StudentAid.gov

- Complete Entrance Loan Counseling

- Under Loans and Grants on the toolbar

- Click "Loan Entrance Counseling"

- Click the Login to Start button next to "I'm an Undergraduate Student"

- Complete Master Promissory Note

- Under Loans and Grants on the toolbar

- Click "Master Promissory Note (MPN)"

- Click the Login to Start button next to "I'm an Undergraduate Student"

The College Financing Plan is a standardized form designed to streamline information regarding costs and financial aid, empowering students to make informed decisions about their educational investments.

To view your College Financing Plan, you must have already completed the FAFSA and received an email notification that you have been offered Financial Aid.

Once your College Financing Plan is prepared, you can access it by following these steps:

- Log in to your Campus Connection account using your UserID and password.

- Click on the Financial Aid tile.

- Click on College Financing Plan.

Financial Aid offers are based on full-time enrollment (12 or more credits). If you have not applied for on-campus housing, are a first-year student and single without dependents with a home address within a 50-mile radius of Wahpeton – your housing and food budget is assumed living off campus with parent(s). If this is not a correct housing assumption, please notify the Financial Aid Office at 701.671.2207 for an update to your budget.

Your offer depends on continued funding from federal, state, and institutional sources. It may be adjusted if any of the following occur:

- Changes in funding levels

- Changes in your financial need

- Changes to your class registration or tuition

- A change in your housing situation

- Receipt of additional scholarships or aid

You must be active in and/or successfully completed 6 or more credits per term for financial aid to disburse. If your financial aid offer is revised, you will be notified by email.

Examples of Active In and/or Successfully Completed Credits

All students are required to meet Satisfactory Academic Progress (SAP).

- Satisfactory Academic Progress toward your degree includes both completing courses with a passing grade and maintaining a minimum GPA.

- If you drop a class, it counts as an attempted course that you did not complete. Dropping a class, as well as receiving an F in a class, will lower your overall completion rate.

- If your completion rate drops below the required 67% of attempted credits, you will be placed on financial aid warning. If you do not meet the 67% standard in a future semester, you will be disqualified from financial aid.

- If you withdraw from all your classes or fail all your classes, you will be disqualified from financial aid, without a warning period.

Click here for more information on Satisfactory Academic Progress and here for the financial impacts of dropping classes or withdrawing.

Cost of Attendance is an estimated amount students can expect to pay for the academic year. Cost of attendance includes direct costs to NDSCS (tuition, fees, and on-campus housing and food) and other indirect costs (books, off-campus housing and food, transportation, loan fees, clothing and other miscellaneous) expenses. Students are not billed for indirect costs outlined on the College Financing sheet. Students may fund their personal expenses through financial aid, employment or out of pocket. For more information regarding the estimates Financial Aid uses to create student budgets including information regarding additional program costs, click here.

Grants and Scholarships are gift aid that generally do not need to be repaid. Click here for more information on scholarships.

Federal and Non-Federal Private Loans do need to be repaid and most accrue interest while students are enrolled. Federal Direct Parent PLUS and non-federal private student loans are not guaranteed as the borrower will need to be approved by passing a credit check. A co-signer, with acceptable credit, would likely be required if a borrower is not able to qualify for additional loans on their own. Click here for more information on alternative loan options.

Federal Work-Study (FWS) provides part-time jobs for students with financial need at NDSCS, allowing them to earn money to help pay education expenses. Eligible students will see a Federal Work-Study offer on their Financial Aid Offer, which they will need to accept or decline. Earnings are paid directly to the student and do not automatically apply to the student’s bill. Find more information about Federal Work-Study here.

Check out the Wildcat Guide to Funding your Education for detailed information regarding the Financial Aid Process, Sources of Financial Aid, Understanding Cost of Attendance and more.

Contact the NDSCS Financial Aid Office at 701.671.2207 or email us at ndscs.fin.aid@ndscs.edu. We’re happy to assist you!